Are you a startup or SME looking for funding for your project?

We help you find it!

Discover how to apply for ENISA, the unsecured financing for start-ups and SMEs, and learn about the requirements, lines of credit and tips to increase your chances of approval.

1. What is ENISA and why it is relevant for entrepreneurs

2. Available ENISA financing lines

3. Comparison between ENISA lines: which one is right for your company

4. General and specific requirements to access ENISA financing

5. Equity contribution: a key element in ENISA’s financial analysis

6. Complete process to apply for ENISA

7. ENISA’s evaluation process

8. Key tips to maximize approval probability

9. Common mistakes you should avoid

10. ENISA Emerging Company Certificate

11. Frequently asked questions about ENISA and startup financing | KLEO

Do you have an innovative startup and are you looking for financing without diluting your capital? Then you need to know ENISA. In this guide created by Kleo, we explain step by step how to access one of the most powerful public financing instruments to boost your company: the ENISA participative loan.

ENISA (Empresa Nacional de Innovación) provides non-collateralized financing to startups and SMEs with viable, innovative projects and strong growth potential. From early stages to expansion, it has become an increasingly popular option for entrepreneurs who want to scale without giving up equity to external investors.

At KLEO, we know the process can seem complex: requirements, loan types, documentation, timelines, financial ratios… That’s why we’ve created this practical and updated guide for 2026, with everything you need to know to prepare and submit your application with confidence.

What ENISA is and how its participative financing works

What types of loans exist and which one suits your company best

Key requirements and necessary documentation

Tips and common mistakes to avoid

How to present your project effectively

Keep reading and discover how to leverage ENISA to finance your startup’s growth with the support of KLEO.

We help you find it!

ENISA has become the most widely used financing option for startups in Spain, serving as a fundamental funding source and the ideal complement to an investment round.

If you are closing an investment round or carrying out a capital increase in your company, ENISA can multiply that capital through a loan under preferential conditions, without requiring you to give up additional equity.

ENISA co-finances your round without dilution: it requires an equity contribution to match its financing, but it does not enter the share capital of your company. This allows you to raise more funding with the same level of dilution.

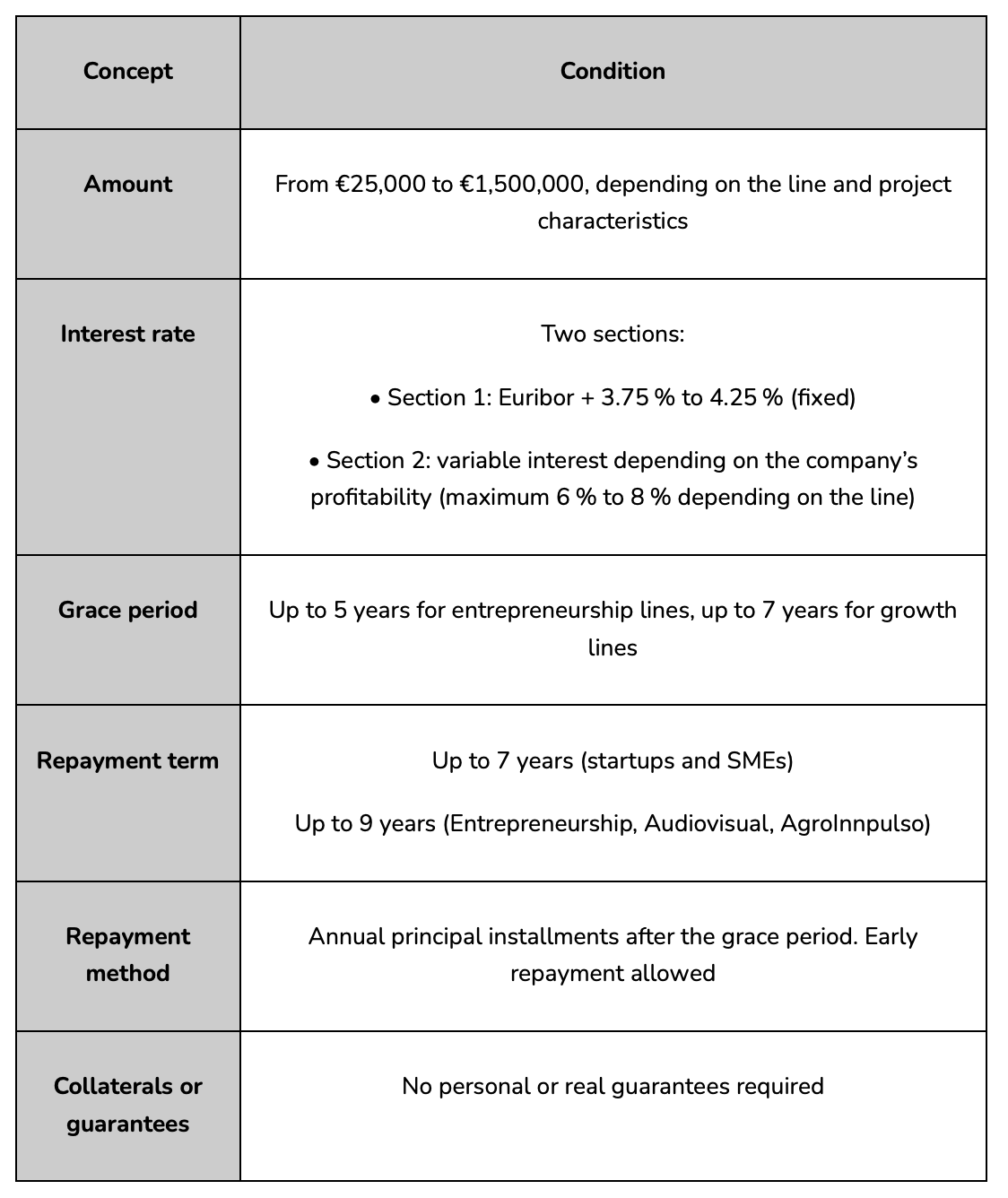

No personal guarantees required: unlike traditional banking, your personal assets or those of your partners are not at risk.

Highly competitive conditions: low interest rates (from Euribor + 3.75%) and grace periods of up to 7 years.

Improves your credibility with investors and third parties: ENISA approval means your project has passed a rigorous technical and financial analysis.

Compatible with other public or private funding: ENISA can be combined with grants, public funds, and other financing instruments.

Flexible use of funds: working capital, technology investment, hiring, or marketing.

At KLEO, we know that accessing financing can be complex and frustrating if you don’t know where to start. That’s why we don’t just assess whether ENISA fits your company—we support you throughout the entire process, from strategy to submission and follow-up, increasing your chances of success and helping you unlock your company’s full potential.

Unlike private investors or traditional funding rounds, ENISA does not take equity in your company. This means:

It is not convertible into equity: the loan does not turn into shares or any future equity instrument.

No dilution for shareholders: the ownership structure remains unchanged.

No interference with shareholders’ agreements: no drag-along rights, lock-ups, or economic clauses.

No personal guarantees or collateral required.

This makes ENISA participative loans an ideal tool to complement an investment round without further dilution, while strengthening your financial structure through subordinated debt that does not constrain management.

ENISA provides non-convertible participative loans, a financial instrument that combines some advantages of traditional debt with the flexibility of venture capital. This type of loan allows startups to raise funding without giving up equity or providing personal guarantees.

It is a hybrid financing instrument between traditional bank debt and equity investment. The main characteristics of ENISA participative loans are:

Non-convertible: the loan does not become shares or equity.

No personal guarantees required.

Subordinated: in the event of liquidation, it ranks behind other debt, strengthening equity for accounting purposes.

Variable interest linked to performance: part of the interest rate depends on the company’s future profitability (second tranche).

Compatible with private investment: ideal to complement a funding round without increasing founder dilution.

Although each line has its own specifics, all ENISA loans share a common structure.

The variable interest (second tranche) is only applied if the company reaches certain profitability levels (net profit over equity or EBITDA over revenue, depending on the case). This mechanism allows ENISA to participate in the project’s success in a limited way, without entering the share capital.

In early-stage startups or businesses not yet profitable, this tranche may not apply for years—or ever—if the defined threshold is not reached.

Strengthens the balance sheet: it is considered quasi-equity, improving solvency ratios and facilitating access to other financing.

No dilution: no equity or control is given up.

Compatible with investment rounds: significantly increases available resources.

Flexible repayment terms: long maturities and grace periods with low short-term pressure.

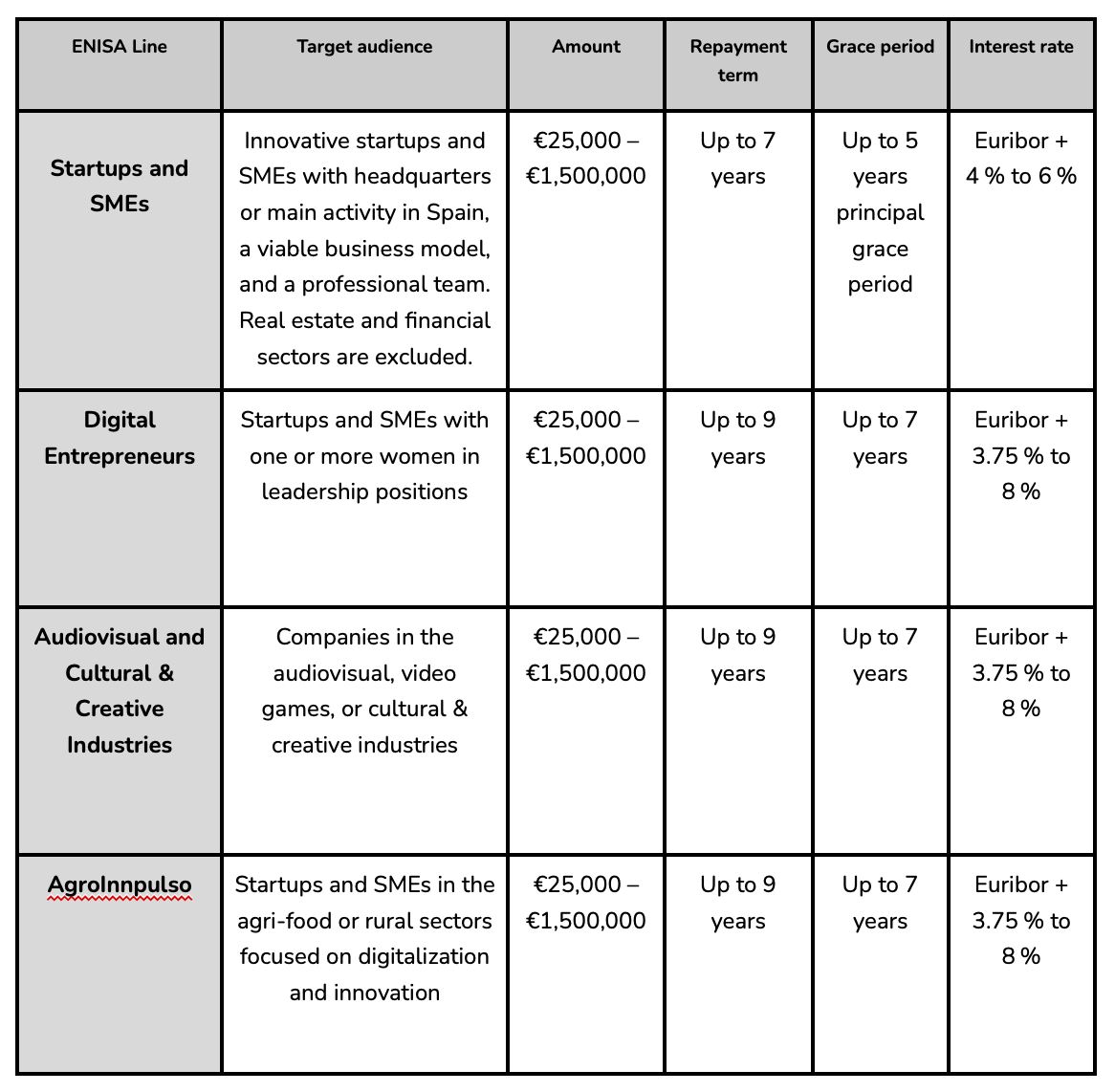

ENISA offers several main financing lines designed to fit different company stages:

Startups and SMEs

This line unifies the former Young Entrepreneurs, Entrepreneurs, and Growth lines. It targets innovative SMEs with scalable business models or clear competitive advantages.

Digital Women Entrepreneurs

For startups and SMEs led by women in digital projects, promoting female leadership in tech businesses.

Audiovisual and Cultural & Creative Industries

For innovative companies in culture, audiovisual, and videogames, with a strong creative and digital component.

AgroInnpulso

For agri-food or rural startups and SMEs focused on digitalization and innovation.

Each line has specific conditions regarding amount, term, and requirements, allowing companies to choose the best fit.

Who is it for?

Startups and SMEs at any stage with innovative, scalable, or technology-driven business models.

Purpose

To finance launch, growth, or consolidation of innovative SMEs across all sectors.

Key differentiator

The general ENISA line: no guarantees, flexible conditions, and interest linked to performance.

Main conditions

Who is it for?

Startups and SMEs led by women, with a significant digital or technological component.

Purpose

To finance growth or consolidation of women-led digital companies.

Conditions

Who is it for?

Companies in audiovisual, videogames, and creative industries with strong digital focus.

Purpose

Audiovisual production, videogames, cultural digitalization, and scaling creative projects.

Key differentiator

Supports sectors traditionally underserved by banks.

Conditions

Who is it for?

Agri-food or rural startups and SMEs focused on innovation, sustainability, or digitalization.

Purpose

Process digitalization, agricultural innovation, energy efficiency, commercial scaling.

Conditions

ENISA offers different financing lines designed to meet the needs of companies at various stages, sectors, and founder profiles. Choosing the right line is critical to increasing your chances of approval, as each one has specific requirements related to company age, team composition, sector, and project maturity.

At KLEO, we analyze all these factors with you and guide you toward the most strategic option. It’s not just about choosing the line that offers the highest amount, but the one where your company fits best and has the highest real probability of approval.

Company age

Is your company less than 2 years old or more than 2 years old?

Founder team profile

Are there women in leadership positions?

Is the founding team experienced and fully dedicated?

Sector of activity

Does your project belong to the cultural, audiovisual, agri-food, or tech sector?

Project maturity stage

Are you just starting, validating a model, or already scaling nationally or internationally?

Innovative startup or SME, early-stage or growing, seeking financing without guarantees

→ ENISA Startups and SMEs

Women-led digital startup

→ ENISA Digital Women Entrepreneurs

Cultural, audiovisual, or creative project

→ ENISA Audiovisual and Cultural & Creative Industries

Agri-food or rural innovation project

→ ENISA AgroInnpulso

Key requirements

Company incorporation: suitable for early-stage or growing companies (no minimum age required).

Equity: the company must have own funds equivalent to the amount of the requested loan.

Innovation and viability: an innovative project, a viable business model, and a solid management team are required, along with a balanced financial structure and demonstrable economic viability.

Key requirements

Presence of women in leadership positions (more than 20% is strongly recommended).

Equity contribution of at least 100% of the requested loan.

Innovative and viable business model from a technical and economic standpoint, either at launch or already validated.

Key requirements

Project linked to the cultural or creative ecosystem.

Strong technological or digital foundation, with a high innovative or transformative component.

Equity contribution of at least 100% of the requested loan.

Key requirements

Activity linked to the rural environment or agri-food value chain.

Strong technological or digital foundation, with a high innovative or transformative component.

Equity contribution of at least 100% of the requested loan.

ENISA assesses whether applicant companies meet a set of legal, formal, and business model conditions that demonstrate solidity, alignment with its public mission, and potential to generate impact.

Below, we explain these requirements in detail and how they are interpreted during the evaluation process.

ENISA only finances SMEs with legal personality, meaning the company must be incorporated as a commercial entity (S.L., S.A., S.L.L., etc.). Sole traders, associations, cooperatives, or foundations are not eligible.

In addition, the company must meet three key conditions:

Have its tax residence in Spain

Be registered with the Spanish Companies Registry

Carry out its main activity in Spain

What Is Considered “Main Activity in Spain”?

A company is considered to carry out its main activity in Spain when most of its operations, customers, revenues, or cost structure are located in Spain. If part of the activity is international, that is not an issue: the financing request simply needs to be clearly limited to the project developed in Spain, excluding international scope from the business plan.

What Is an SME?

For ENISA purposes, an SME is any company with fewer than 250 employees and either annual turnover below €50 million or a balance sheet total below €43 million.

What If the Company Belongs to a Business Group?

If the applicant company belongs to a group, both the applicant and the linked entities must individually meet the SME definition under EU criteria. In other words, if the company is part of a group, these thresholds apply on a consolidated basis.

This is particularly important if there are foreign subsidiaries, corporate shareholders, or entities linked through direct or indirect control.

ENISA finances companies across most economic sectors, provided they develop innovative business models. However, there are important exclusions to consider:

Sector-specific exceptions: AgroInnpulso and Audiovisual & Cultural Industries target specific sectors but do not exclude others. These are specialized lines, not restrictive ones.

This is one of the most important—and most interpretive—criteria in any ENISA application. ENISA does not require proprietary technology or disruptive algorithms, but it does expect the project to:

Examples of innovation considered valid by ENISA include:

What matters most is that the project has a strategic vision and future projection, rather than being just another undifferentiated company in its sector.

Beyond the idea itself, ENISA seeks to finance projects capable of generating economic impact and employment, scaling revenues, and remaining sustainable over time.

This means demonstrating that:

ENISA does not finance companies created solely for self-employment, lacking ambition to scale, without traction potential, or with unstable structures. Its goal is to support projects that can grow, attract investment, and become relevant players in their sector.

At KLEO, we review all these requirements to ensure your company meets ENISA’s criteria before starting the application.

In addition to legal and business model requirements, companies seeking ENISA financing must demonstrate that their project is financially viable, balanced, and sustainable. This does not mean being profitable or having spectacular figures, but meeting minimum conditions that ensure the loan can be repaid without jeopardizing business continuity.

These requirements apply to all ENISA lines, although the level of scrutiny may vary depending on company stage and requested amount.

ENISA closely analyzes the company’s balance sheet and income statement, looking for a healthy financial structure. This means:

For companies with financial history (more than two closed fiscal years), ENISA evaluates financial ratios such as liquidity, solvency, leverage, profitability, and debt service coverage. For early-stage companies, the analysis is more qualitative, but financial coherence is still required.

A compelling business plan alone is not enough. ENISA requires the plan to be coherent, detailed, and realistic, with five-year projections aligned with the company’s current situation.

ENISA places particular value on:

Ultimately, the project must demonstrate that it is executable, economically sustainable, and scalable.

ENISA does not require profitability, but it does require a clear revenue generation strategy or a structure that justifies scalability in the short or medium term.

This means:

This section is especially critical for B2C, SaaS, platform, or marketplace startups in early stages. A clear acquisition, retention, and monetization strategy can make the difference between approval and rejection.

One of the most relevant and closely monitored requirements is the equity contribution made by the company, which must be directly linked to the submitted business plan. Failure to meet this criterion can lead to automatic rejection or a significant reduction in the approved amount.

ENISA requires an equity contribution (share capital and/or share premium) equivalent to at least 100% of the requested loan. This minimum is necessary for eligibility, but the final loan amount also depends on factors such as:

Contributions may come from existing shareholders or new investors, provided their irrevocable nature can be demonstrated.

Only irrevocable contributions to share capital or share premium are accepted. ENISA only accepts participative loans, bridge loans, or convertible notes if they are to be imminently and irrevocably converted into equity, and they must be fully converted and registered at the time of ENISA loan formalization.

ENISA requires that contributions be recent or in the process of imminent formalization, and that the funds are clearly allocated to executing the presented business plan.

-Most of the capital is still available as cash, and

-There is clear traceability between the contribution and the business plan justifying the request.

During analysis and until approval, ENISA accepts the following as proof:

Important: the ENISA loan is not disbursed until the registered public deed of capital increase is provided. From the favorable resolution, the company has 60 calendar days to submit this documentation and formalize the loan.

Applying for an ENISA loan may seem complex, but with proper preparation, the chances of success increase significantly. At KLEO, we guide you step by step throughout the process.

Before submitting the application, it is essential to:

This phase is critical to avoid rejections or delays.

The first step is to complete the official form through ENISA’s portal and upload all required documents. It is important to:

Required documentation includes legal, tax, financial, and corporate information such as:

At KLEO, we prepare all this documentation with you to ensure it is coherent, complete, and aligned with ENISA’s internal criteria.

This phase verifies that the application is formally valid and meets minimum requirements. ENISA checks:

If the application fails this stage, it is deemed inadmissible and rejected without technical evaluation.

Once admitted, the file is assigned to an ENISA analyst who conducts an in-depth evaluation of:

The analyst may request additional information or clarifications. This phase typically lasts 2–3 months, and the quality and speed of responses can significantly influence the final outcome.

After technical analysis, the file is reviewed by the Investment Committee (up to €300,000) or the Board of Directors (over €300,000).

Approval leads to formalization within 60 days. Rejection includes a brief explanation, and a new application may be submitted once issues are corrected.

Once formal approval has been granted by ENISA, the application file is transferred to the legal department, which is responsible for coordinating the formalization phase. At this stage, the company must review and sign the loan contractual documentation and submit the final supporting documents, such as the registered capital increase deed filed with the Commercial Registry (if it has not already been provided).

Once all documentation is in order, ENISA schedules the signing before a notary, which takes place in person in Madrid, usually at the institution’s reference notary office. The individual with sufficient power to represent the company must attend. During this appointment, the loan agreement is signed and the disbursement process is activated.

The loan amount is transferred to the company’s bank account in the days following the signing, once all documentary validation has been completed.

At KLEO, we guide you in properly structuring the capital contribution to ensure this critical step does not delay or block the formalization of the loan.

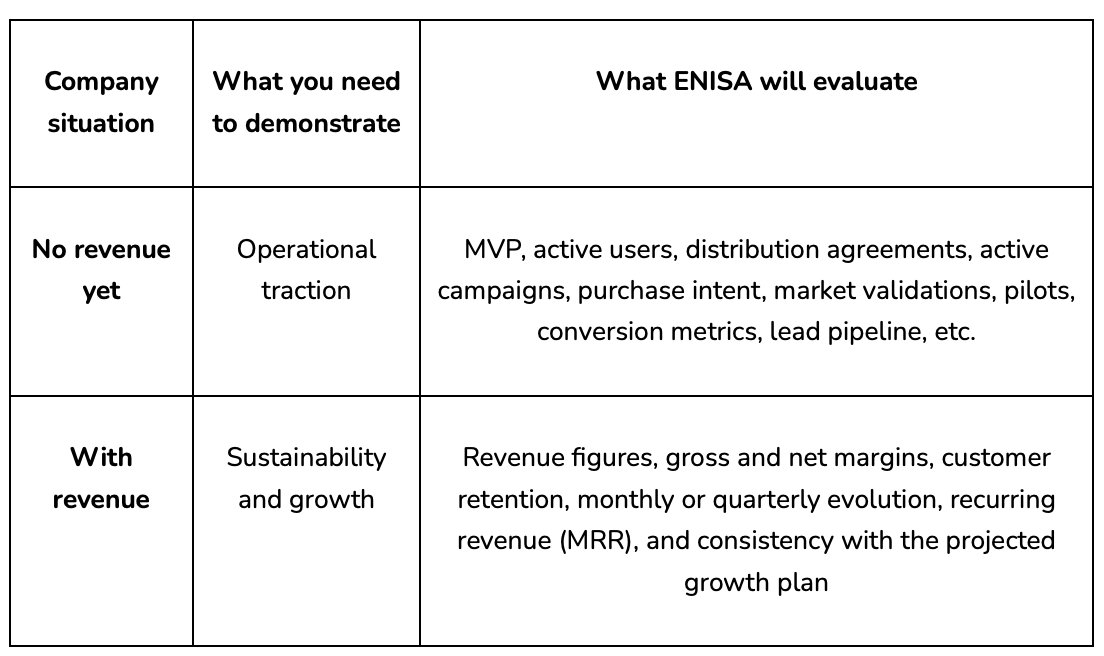

One of the factors that most influences how your application is assessed is whether your company has already started generating revenue. Although ENISA finances both pre-revenue companies and those that are already generating sales, the analytical approach changes significantly depending on this point.

When a company already has a track record and closed annual accounts, ENISA applies a much more technical evaluation process, combining rigorous financial analysis with a strategic review of the project. This is known as the ENISA rating model for companies with financial history.

The evaluation structure is divided into two blocks:

Both ratings are combined to determine whether the application surpasses the minimum required threshold. Below is a detailed explanation of each part and how it is assessed.

This block is the most relevant and carries decisive weight in the decision. The goal is to measure the company’s economic health, evolution, and future solvency through 12 financial indicators, grouped into two categories: economic analysis (38.1%) and financial analysis (61.9%).

Ratios are calculated on:

Economic Analysis

Financial Analysis

Important: ENISA’s system assigns a score to each ratio and, based on an internal algorithm, gives a final rating. The analyst may adjust the rating by +/- 2 positions if solid qualitative elements justify it.

Although it carries less weight, this section allows for nuance or reinforcement of the financial analysis. Elements evaluated explain the context, strategy, and execution capacity of the team, grouped into two main blocks:

A. Market, Demand, and Product

B. Shareholders and Team

A very strong qualitative block cannot compensate for poor financial rating but can justify a slight improvement, especially if numbers are neutral or slightly weak.

When a company has not yet completed full financial years—for example, less than two years since incorporation—ENISA adapts its analysis model. Although it cannot rely on historical financials, a well-founded business plan with realistic and coherent projections is required.

This means the analysis remains mixed:

Both parts are structured and weighted together to determine if the application meets the minimum rating to be approved.

Even without historical data, ENISA thoroughly analyzes 5-year financial projections, evaluating if revenue, margins, cost structure, investment, and future profitability are reasonable and consistent with the business model.

Key points evaluated:

Although classic financial ratios like ROA or debt coverage are not calculated, a technical judgment is made on the overall financial viability based on the submitted plan.

Qualitative analysis is especially important for pre-traction companies. Evaluated blocks include:

Market and value proposition

Team and structure

Not having historical data does not prevent applying for ENISA, but it requires a solid, credible business plan with sound financial logic. At KLEO, we help structure the plan according to ENISA’s real criteria, reinforcing key points and anticipating what the analyst will look for.

Since the entry into force of the Startup Law (Law 28/2022), ENISA is responsible for issuing the Emerging Company Certificate, officially certifying that a company meets the legal conditions to be considered a startup in Spain.

This certificate does not grant financing but is essential for accessing fiscal, labor, and administrative benefits provided by law and has become a key tool to improve the startup ecosystem.

Main advantages of the Certificate:

Main requirements to request the Certificate:

ENISA evaluates whether the applying company meets the Startup Law criteria. Key points include:

Resolution time and validity:

ENISA resolves applications in approximately 20–30 days. The certificate is valid for 3 years, renewable annually while requirements continue to be met, up to the legal limit (5 or 7 years depending on the case).